Fsa Account Limits 2024

Fsa Account Limits 2024. 2024 last day to submit claims is april 30, 2025. The irs set a maximum fsa contribution limit for 2024 at $3,200 per qualified fsa ($150 more than the prior year).

In 2024, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050). The latest mandated fsa employee contribution limits on how much employees can contribute to these accounts is shown in the table below.

The Internal Revenue Service Announced That The Health Care Flexible Spending Account (Fsa) Contribution Limit Will Increase From $3,050 To $3,200 In 2024.

Increases to $3,200 in 2024 (up $150 from.

For 2024, There Is A $150 Increase To The Contribution Limit For These Accounts.

The federal flexible spending account program (fsafeds) is sponsored by the u.s.

In 2024, Workers Can Add An Extra $150 To Their Fsas As The Annual Contribution Limit Rises To $3,200 (Up From $3,050).

Images References :

Source: www.ees-net.com

Source: www.ees-net.com

Employee Benefits EES, If you don’t use all the funds in your account, you. Keep reading for the updated limits in each category.

Source: 2023vjk.blogspot.com

Source: 2023vjk.blogspot.com

Wadidaw 2023 Fsa Limits Irs Ideas 2023 VJK, The irs set a maximum fsa contribution limit for 2024 at $3,200 per qualified fsa ($150 more than the prior year). For 2024, the fsa annual salary reduction limits are set at $3,200, up almost 5% from $3,050 in 2023.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

The Best Order of Operations For Saving For Retirement, But if you do have an fsa in 2024, here are the maximum amounts you can contribute for 2024 (tax returns normally filed in 2025). For plans that allow a.

Source: gogetcovered.com

Source: gogetcovered.com

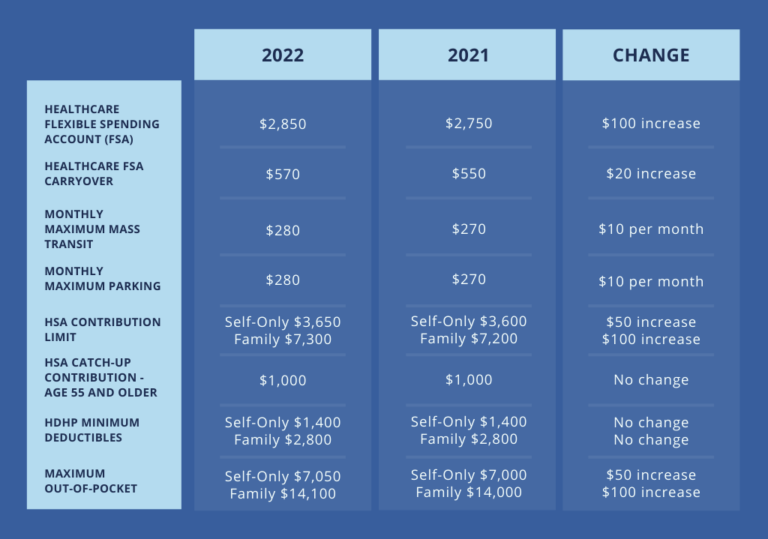

IRS Releases 2023 Limits for Flexible Spending Accounts (FSA), Health, The 2024 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2023). Keep reading for the updated limits in each category.

Source: 2022jwg.blogspot.com

Source: 2022jwg.blogspot.com

What Is The Fsa Limit For 2022 2022 JWG, The fsa contribution limits increased from 2023 to 2024. Employees participating in an fsa can contribute up to $3,200 during the 2024 plan year, reflecting a $150 increase over the 2023 limits.

Source: www.wexinc.com

Source: www.wexinc.com

2022 limits for FSA, commuter benefits, and more announced WEX Inc., The amount of money employees could carry over to the next calendar year was limited to $550. The fsa contribution limits increased from 2023 to 2024.

Source: rmcgp.com

Source: rmcgp.com

2022 Limits for FSA, HSA, and Commuter Benefits RMC Group, The federal flexible spending account program (fsafeds) is sponsored by the u.s. For 2024, the fsa annual salary reduction limits are set at $3,200, up almost 5% from $3,050 in 2023.

Source: www.wexinc.com

Source: www.wexinc.com

Happy 2023! Get educated with our top 2022 blog posts WEX Inc., The fsa maximum contribution is the maximum. However, the act allows unlimited funds to be carried over from plan.

Source: donicaqterrie.pages.dev

Source: donicaqterrie.pages.dev

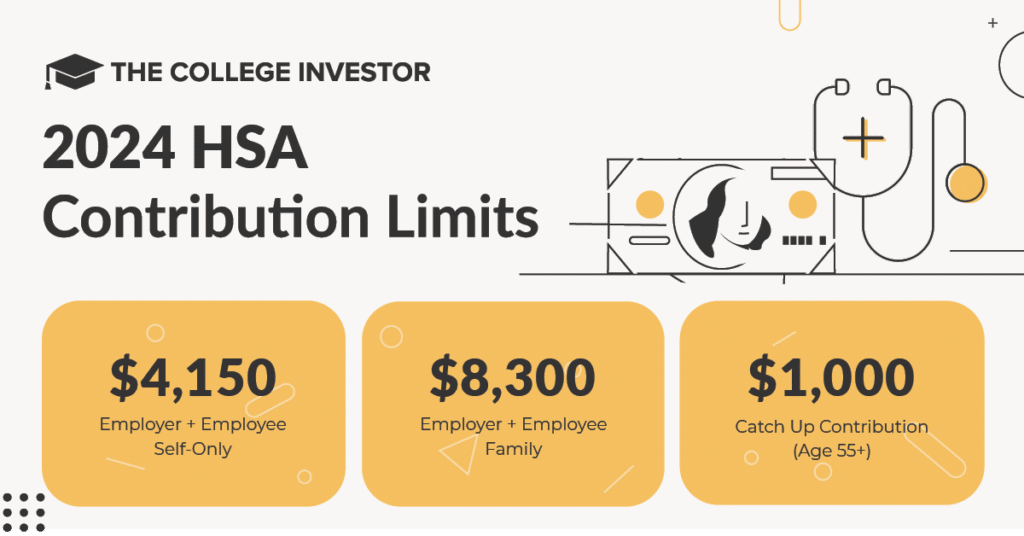

Hsa Contributions 2024 Ardys Winnah, Employers have the choice to permit. Employees participating in an fsa can contribute up to $3,200 during the 2024 plan year, reflecting a $150 increase over the 2023 limits.

Source: healthcarepathfinder.com

Source: healthcarepathfinder.com

Employer Health Saving Accounts (HSA) vs Flexible Spending Accounts (FSA), In 2024, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050). Office of personnel management and.

Fsas Only Have One Limit For Individual And Family Health.

The fsa maximum contribution is the maximum.

The 2024 Fsa Contributions Limit Has Been Raised To $3,200 For Employee Contributions (Compared To $3,050 In 2023).

However, the act allows unlimited funds to be carried over from plan.